The Impact of Fintech and Digital Platforms on Financial Inclusion in the Informal Sector of Ghana

Abstract:

Financial technology (fintech) is widely

recognized as an effective tool to drive financial inclusion across the world.

However, its impact on financial inclusion in the informal sector is yet to be

understood especially in developing countries. This study assessed the impact

of fintech and digital platforms on financial inclusion in the informal sector

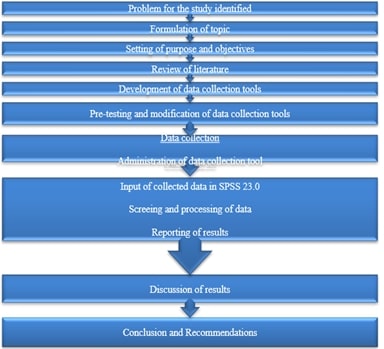

of Ghana. A descriptive cross-sectional research design was employed to select

365 participants in the informal sector from eight regions of Ghana through

multistage sampling method for data collection. Data was collected using a

5-point Likert scale that was adapted with items to assess the role of fintech

and adoption by people in the informal sector. After the data was analyzed with

SPSS software version 23.0, it was a found that majority of participants took a

neutral stance on the role and adoption of fintech; suggesting lack of

awareness on fintech in the informal sector. The study can conclude that Ghana

can benefit from the impact of fintech and digital platforms on financial

inclusion in the informal sector through education and creation of awareness as

there is lack of knowledge on fintech and its use in the sector.

References:

[1]. Leong,

K., & Sung, A., 2018, FinTech (Financial Technology): what is it and how to

use technologies to create business value in fintech way. International Journal

of Innovation, Management and Technology, 9(2), 74-78.

[2]. Popescu,

A. D., 2019, Empowering financial inclusion through fintech. Social Sciences

and Education Research Review, 6(2), 198-215.

[3]. Jarvis,

R., & Han, H., 2021, FinTech innovation: Review and future research

directions. International Journal of Banking, Finance and Insurance

Technologies, 1(1), 79-102.

[4]. Gomber,

P., Koch, J. A., & Siering, M., 2017, Digital Finance and FinTech: current

research and future research directions. Journal of Business Economics,

87, 537-580.

[5]. Dharmadasa,

P. D. C. S., 2021, Fintech services” and the future of financial

intermediation: a review. Sri Lanka Journal of Economic Research, 8(2),

21.

[6]. Sahay,

M. R., von Allmen, M. U. E., Lahreche, M. A., Khera, P., Ogawa, M. S.,

Bazarbash, M., & Beaton, M. K, 2020, The promise of fintech: Financial

inclusion in the post COVID-19 era. International Monetary Fund.

[7]. Anand,

D., & Mantrala, M., 2019, Responding to disruptive business model

innovations: the case of traditional banks facing fintech entrants. Journal

of Banking and Financial Technology, 3, 19-31.

[8]. Hua,

X., & Huang, Y., 2021, Understanding China’s fintech sector: development,

impacts and risks. The European Journal of Finance, 27(4-5), 321-333.

[9]. Tidjani,

C., 2020, Readiness to the FinTech industry in developing countries: an

overview of prospective factors impacts. Handbook on Ethics in Finance,

1-32.

[10]. Goswami,

S., Sharma, R. B., & Chouhan, V., 2022, Impact of financial technology

(Fintech) on financial inclusion (FI) in Rural India. Universal Journal of

Accounting and Finance, 10(2), 483-497.

[11]. Tarawali,

J. F., 2020, Impacts of FinTech innovations on financial inclusion in

developing countries and the challenges they face-A case study on Sierra Leone (Doctoral

dissertation, Politecnico di Torino).

[12]. Harsono,

I., & Suprapti, I. A. P., 2024, The role of fintech in transforming

traditional financial services. Accounting Studies and Tax Journal (COUNT),

1(1), 81-91.

[13]. Song,

N., & Appiah-Otoo, I., 2022, The impact of fintech on economic growth:

Evidence from China. Sustainability, 14(10), 6211.

[14]. Yáñez-Valdés,

C., & Guerrero, M., 2023, Assessing the organizational and ecosystem

factors driving the impact of transformative FinTech platforms in emerging

economies. International Journal of Information Management, 73, 102689.

[15]. Kandpal,

V., & Mehrotra, R., 2019, Financial inclusion: The role of fintech and

digital financial services in India. Indian Journal of Economics &

Business, 19(1), 85-93.

[16]. Madichie,

N. O., Nkamnebe, A. D., & Ekanem, I. U., 2020, Marketing in the informal

economy: an entrepreneurial perspective and research agenda. Entrepreneurship

Marketing, 412-428.

[17]. Farazi,

S., 2014, Informal firms and financial inclusion: status and determinants. Journal

of international commerce, Economics and policy, 5(03), 1440011.

[18]. Salampasis,

D., & Mention, A. L., 2018, FinTech: Harnessing innovation for financial

inclusion. In Handbook of blockchain, digital finance, and inclusion,

volume 2 (pp. 451-461). Academic Press.

[19]. Odei-Appiah,

S., Wiredu, G., & Adjei, J. K., 2022, Fintech use, digital divide and

financial inclusion. Digital Policy, Regulation and Governance, 24(5),

435-448.

[20]. Beck,

T., 2020, Fintech and financial inclusion: Opportunities and pitfalls (No.

1165). ADBI working paper series.

[21]. Makina,

D., 2019, The potential of FinTech in enabling financial inclusion. In

Extending financial inclusion in Africa (pp. 299-318). Academic Press.

[22]. W. E.

F. Ward., 2023, A history of Ghana. Routledge.

[23]. Yendaw,

E., 2022, Cross-border migration of itinerant immigrant retailers in Ghana. Journal

of International Migration and Integration, 23(1), 205-225.

[24]. Adei,

D., Braimah, I., Mensah, J. V., Acquah Mensah, A., & Agyemang-Duah, W.,

2021, Improving upon the working environment of informal sector workers in

Ghana: The role of planning. Cogent Medicine, 8(1), 1911441.

[25]. Senyo,

P. K., Karanasios, S., Agbloyor, E. K., & Choudrie, J., 2024,

Government-Led digital transformation in FinTech ecosystems. The Journal of

Strategic Information Systems, 33(3), 101849.

[26]. Asif,

M., Khan, M. N., Tiwari, S., Wani, S. K., & Alam, F., 2023, The impact of

fintech and digital financial services on financial inclusion in India. Journal

of Risk and Financial Management, 16(2), 122.

[27]. Thermaenius,

V., & Östling, L., 2018, Financial Inclusion in the Age of FinTech: A

multiple case study of FinTech companies’ role for financial inclusion in

India.

[28]. Coffie,

C. P. K., & Hongjiang, Z., 2023, FinTech market development and financial

inclusion in Ghana: The role of heterogeneous actors. Technological

Forecasting and Social Change, 186, 122127.

[29]. Jack,

W., & Suri, T., 2014, Risk sharing and transactions costs: Evidence from

Kenya's mobile money revolution. American Economic Review, 104(1),

183-223.

[30]. Nan,

W., Zhu, X., & Lynne Markus, M., 2021, What we know and don't know about

the socioeconomic impacts of mobile money in Sub‐Saharan Africa: A systematic

literature review. The Electronic Journal of Information Systems in

Developing Countries, 87(2), e12155.

[31].

Broni Jr, F. E., & Owusu, A., 2020,

Blockchain readiness: expert perspectives from a developing economy. In

Handbook of Research on Managing Information Systems in Developing Economies

(pp. 160-177). IGI Global